Christmas is a great time for most of us – but for me it’s not the big day itself that I look forward to, it’s the hype around ecommerce and digital trends.

The festive season can quite often make or break a lot of ecommerce businesses, with many spending more money on marketing than any other portion of the year. If you haven’t already, check out our top tips for optimising your ecommerce website for Christmas. It’s full of great tips to make sure your website is primed and ready for an increase in sales.

If you are a large ecommerce brand, you’ve probably already added all of your Christmas products to your website after researching the best trends and what is likely to be popular this year. If you’re a smaller or medium-sized retailer – what can we learn from the last couple of years to help influence your marketing and product decisions this year?

E-commerce spend has fallen

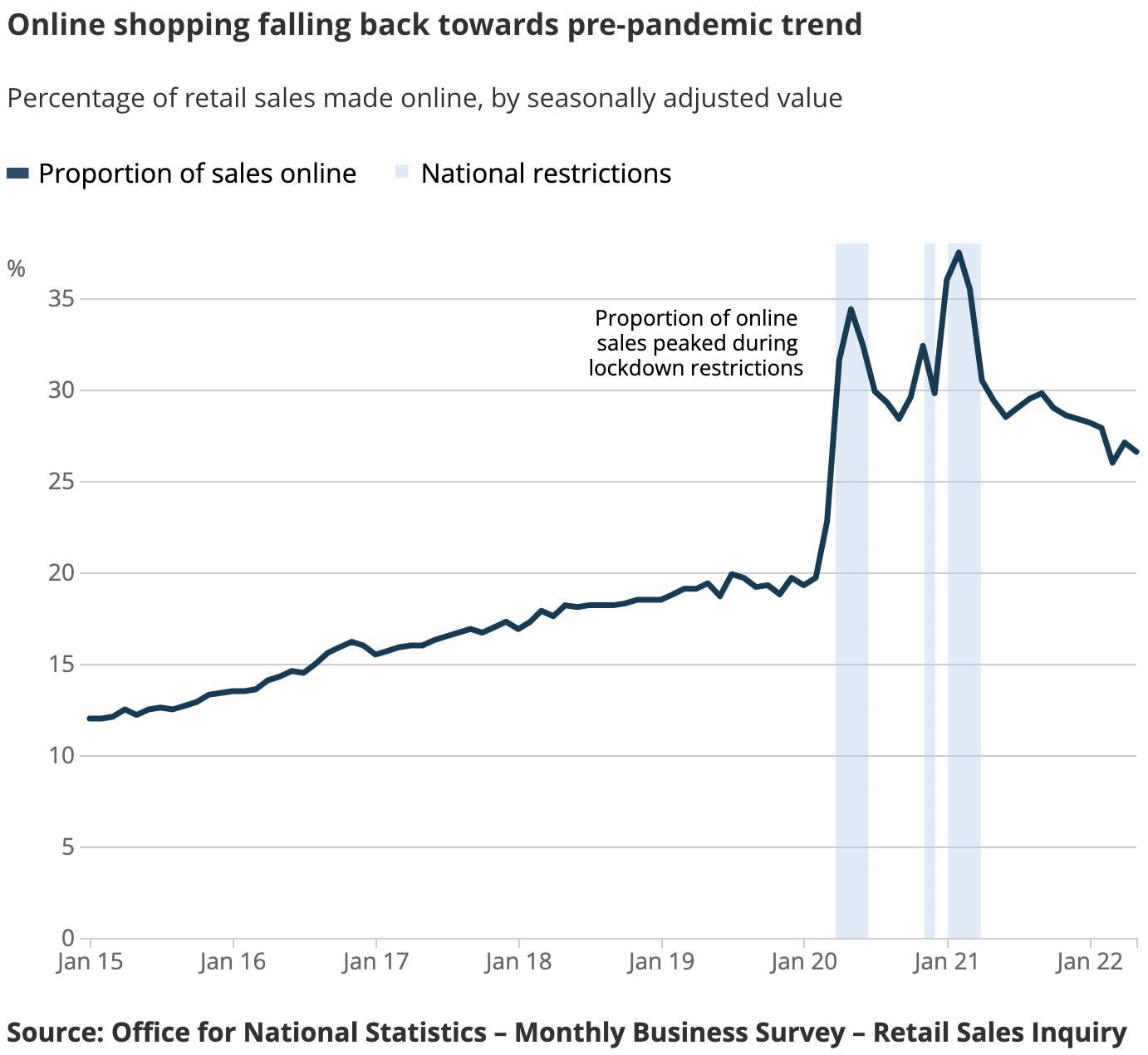

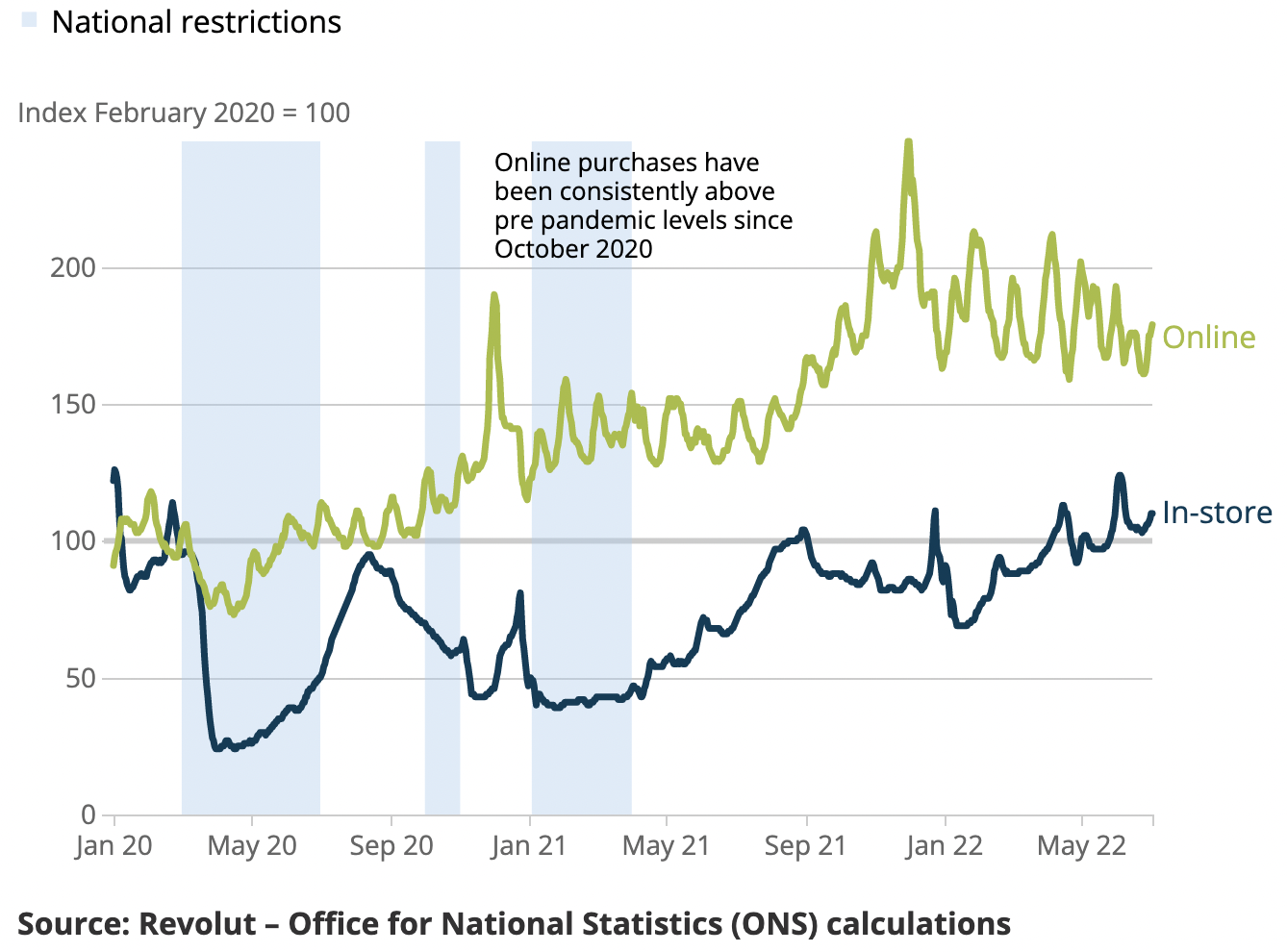

After the UK lockdowns ended in 2021, online spend started to fall almost instantly and has continued to do so throughout 2022. While the high street has been struggling since the 2008 financial crash, e-commerce isn’t without its problems either, with online spending falling back to pre pandemic levels in many areas of retail.

Despite such a large increase in spend during the pandemic, retailers have not been able to sustain these levels, with online spend currently falling and no noticeable signs of a resurgence yet. A significant part of this could also relate to the cost of living crisis and consumers being less able or willing to spend in certain areas due to inflation and squeezed household budgets.

Despite the drop in online spending, the high street has actually seen a rise, with consumers now spending more on the high street than they were before the pandemic.

The furniture ecommerce sector has taken a hit this year

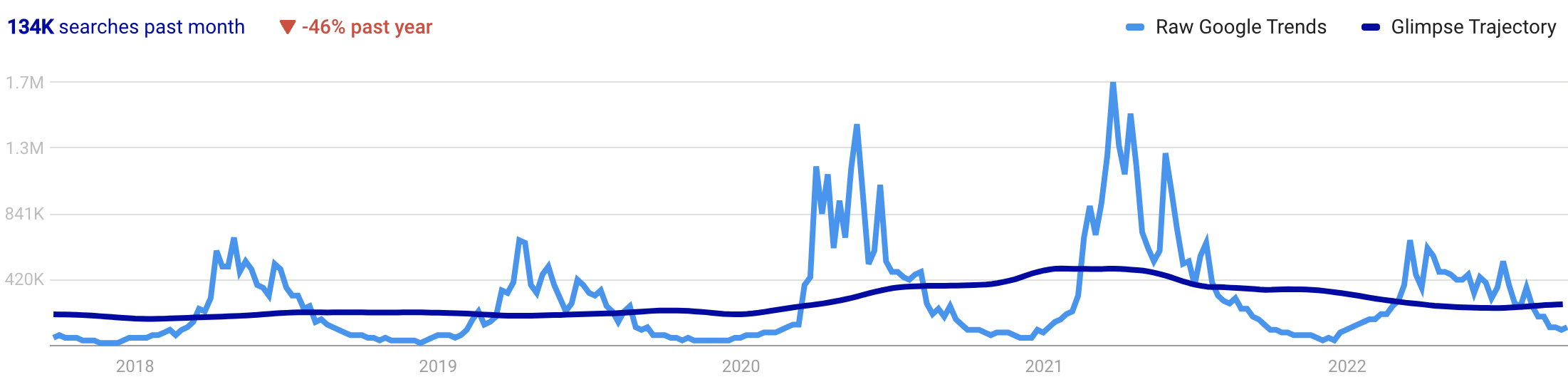

During the months of 2020/21 when people spent a lot more time at home than usual, furniture and other household goods saw a large increase in popularity as many people spent their spare cash on their home and decorating.

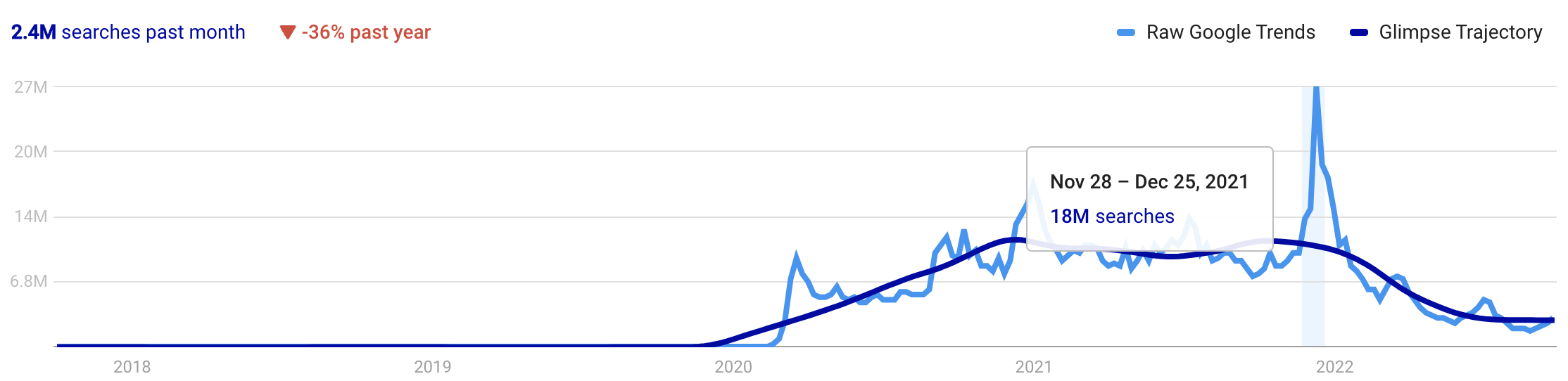

As we can see with the below graph, exterior furniture such as ‘garden furniture’ has seen a substantial drop in overall traffic this year compared to 2020/21, going all the way back down to pre-pandemic levels. This is despite a UK heatwave in the summer of 2022, which you might expect would have more people making use of outside spaces than usual.

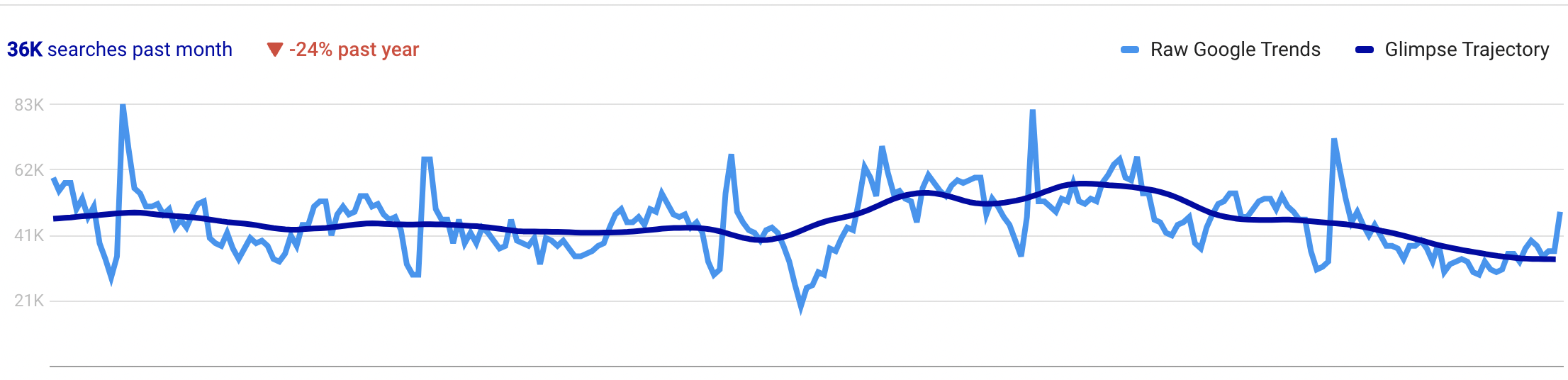

On the flip side, if garden furniture was hot on the agenda in the summer, we would usually see this trend diverge into the home somewhat with seasonal changes, with an increase in search volume around interior furniture heading into winter.

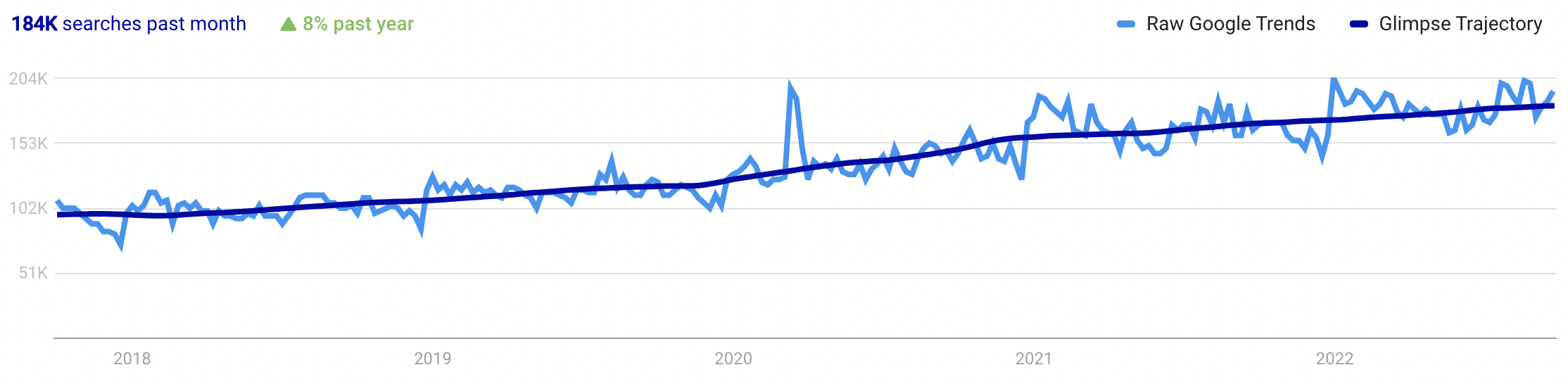

Interestingly, we’ve actually seen the reverse in 2022. Searches for ‘Sofas’, including for some of the UK’s biggest Sofas retailers, has dipped below pre-pandemic levels and shows no signs of changing anytime soon. Winter can often be an important time for the furniture industry, with people typically spending more time indoors and more money on their interior. Therefore it’s really important for retailers to understand what consumers are looking for, if not for sofas, and how they can use that information for the benefit of the business.

It’s not all bad news for the Sofa industry

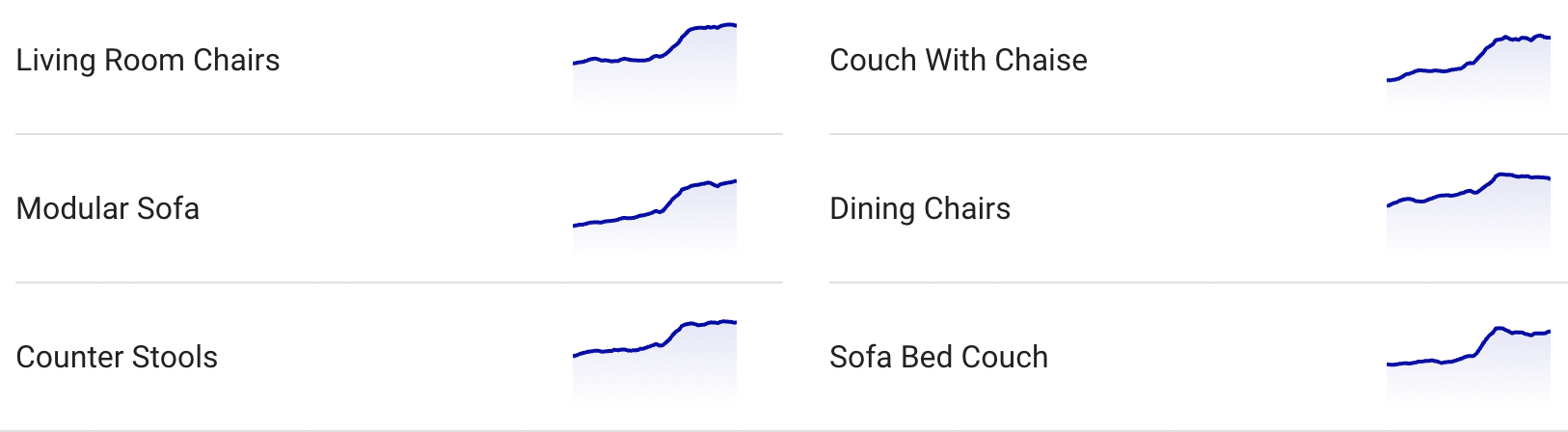

Despite the term “Sofa”/”Sofas” on a downward trajectory since the end of the pandemic, longer tail search terms have either seen an increase in search visibility or have sustained their previous search volumes over 2022. Looking at the graphs below, we can see that search visibility for “Sofa Beds”, “Modular Sofas”, “Living Room Chairs” and “Counter Stools” have remained strong – with no signs of slowing down heading into winter.

What does this mean for online retailers?

For businesses in a similar position, where it appears at first glance that search volumes around your products are falling, it is important to take a holistic view to your key terms, branching out and researching as many different variations of your products as possible.

Looking at the graphs above, you would be forgiven to think search volumes around sofas are falling altogether, but taking a closer look into some longer tail terms shows us that the demand is still there and continuing to grow in some key areas. It’s just that consumer search behaviour is evolving and people understand that searching for ‘sofas’ in isolation won’t bring them the kind of results that they want.

This is where SEO really comes into play. A good SEO agency or in-house team should be doing a lot more than simply optimising your website pages. They also need to be looking at the vast landscape of your e-commerce brand and marketplace, as well as your audience, to really understand product and search trends in a way that will make a real difference to your sales in the short, medium and long-term.

Online spend may be falling, but the number of businesses going digital is increasing. This means it is vital to take control of your SEO strategy and really get to grips with how SEO can drive valuable and sustained revenue growth through your website.

What else has seen an increase in online spend since the pandemic?

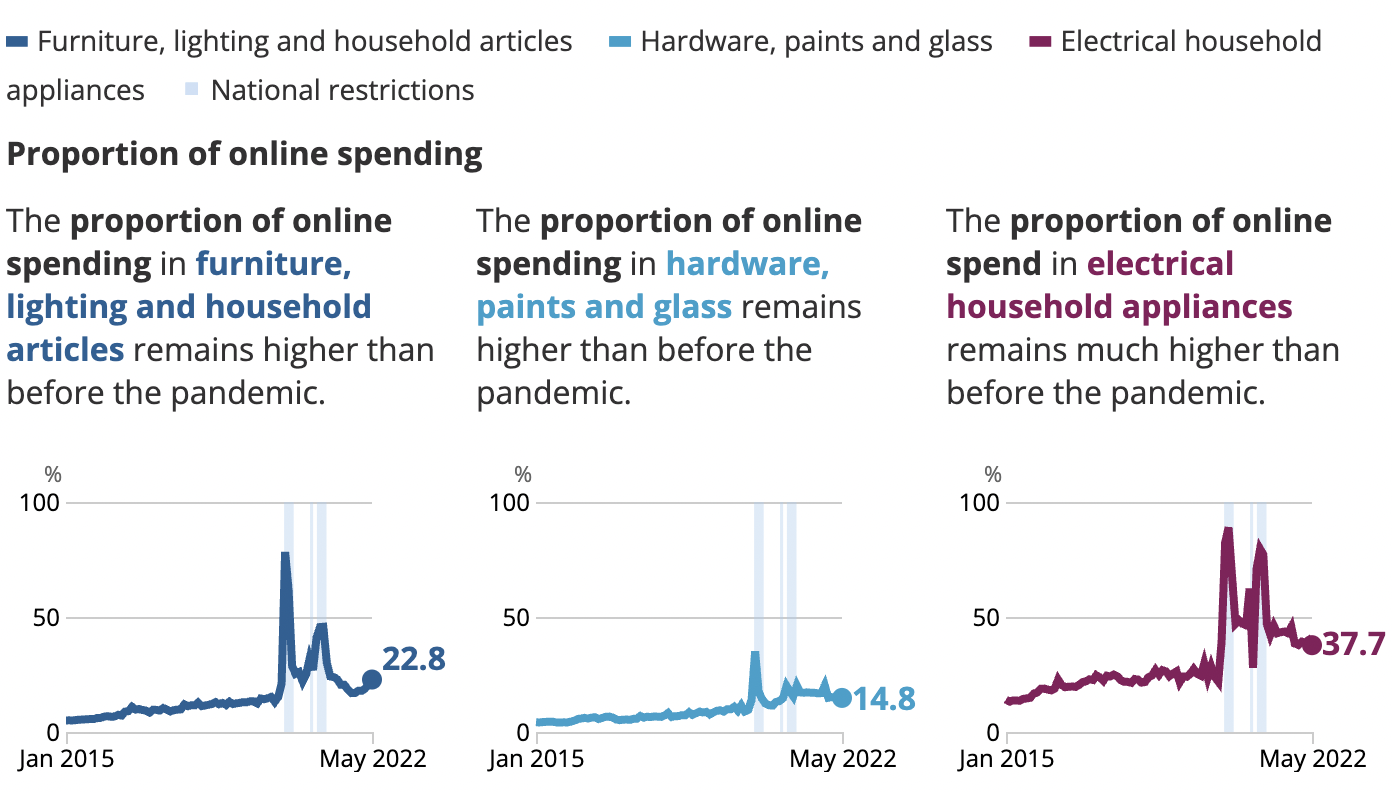

It’s no surprise that household goods in general saw a huge increase in online sales during the pandemic, and although demand has dropped, their levels of sales have remained higher online than on the high street – with electrical household appliances seeing the greatest increase.

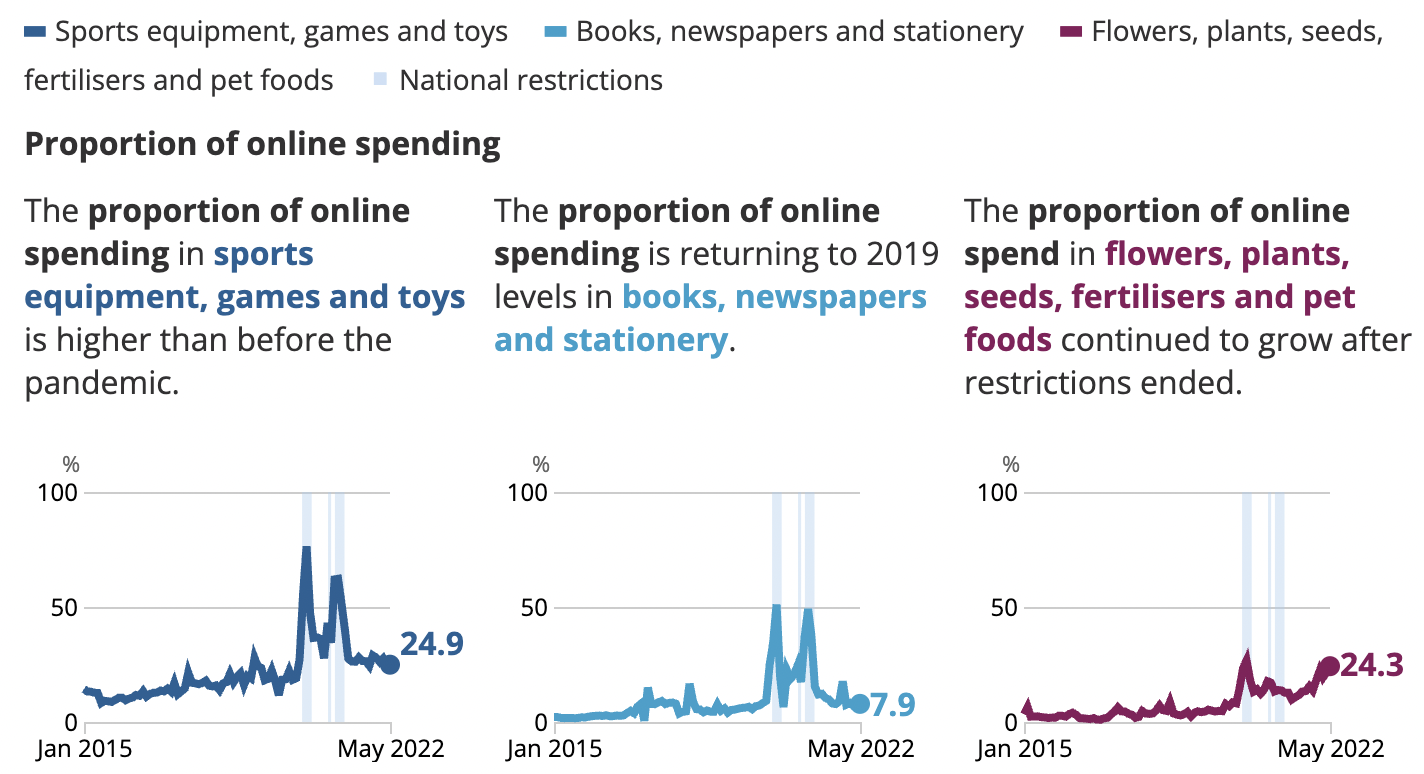

Sports equipment, games and toys also saw an increase in sales during the pandemic with sales remaining at pandemic levels (even when restrictions ended). Similarly, sales of Flowers, Plants, Seeds, Fertilisers and Pet Food actually continued to increase in sales after restrictions were lifted, with no clear signs of slowing down anytime soon.

Looking at the data above, we can also see that Pet Food saw an increase during the pandemic. This doesn’t really come as much surprise, with an estimated 3.2 million pets purchased during lockdown. Dog food in-particular has seen a steady increase over the past 5 years anyway.

How does this impact Christmas?

Thankfully, this won’t be the first Christmas without a lockdown, with restrictions starting to ease in the United Kingdom from February 2021 and almost all restrictions scrapped by summer. However, Covid had a long term impact on society and consumer spending habits and trends, playing a huge role in the Christmas of 2021.

Looking at the graph above, we can see that despite no restrictions being in place during December 2021, “Covid” as a search term saw its biggest spike since the pandemic, with over 18 million searches between 28th November and 25th December.

Knowing that Covid caused such a huge shift in consumers habits, data like this is really important in helping us inform marketing decisions for the future, as it shows that despite not having any physical restrictions in place, Covid was still front and centre in many people’s minds.

During December of 2021, “Covid” as a search term actually saw more searches than the term “Christmas”, with over 30m searches vs just over 17m for “Christmas”.

How are things looking for Christmas 2022?

This year, we have seen the search volumes around Covid shrink dramatically, with overall search volume around this term much lower than last year. There’s still some search volume around this term and it’s likely to still be in the minds of many moving forward into what is typical ‘flu’ season – but it’s a lot less than last year.

This is great news for retailers, as we know from experience that any political or societal upsets can have a knock-on effect to the economy, causing rifts throughout various retail sectors. This year Covid has been replaced with ‘the cost of living’ and although people will likely be spending less, more importantly they will be finding new places to spend their money.

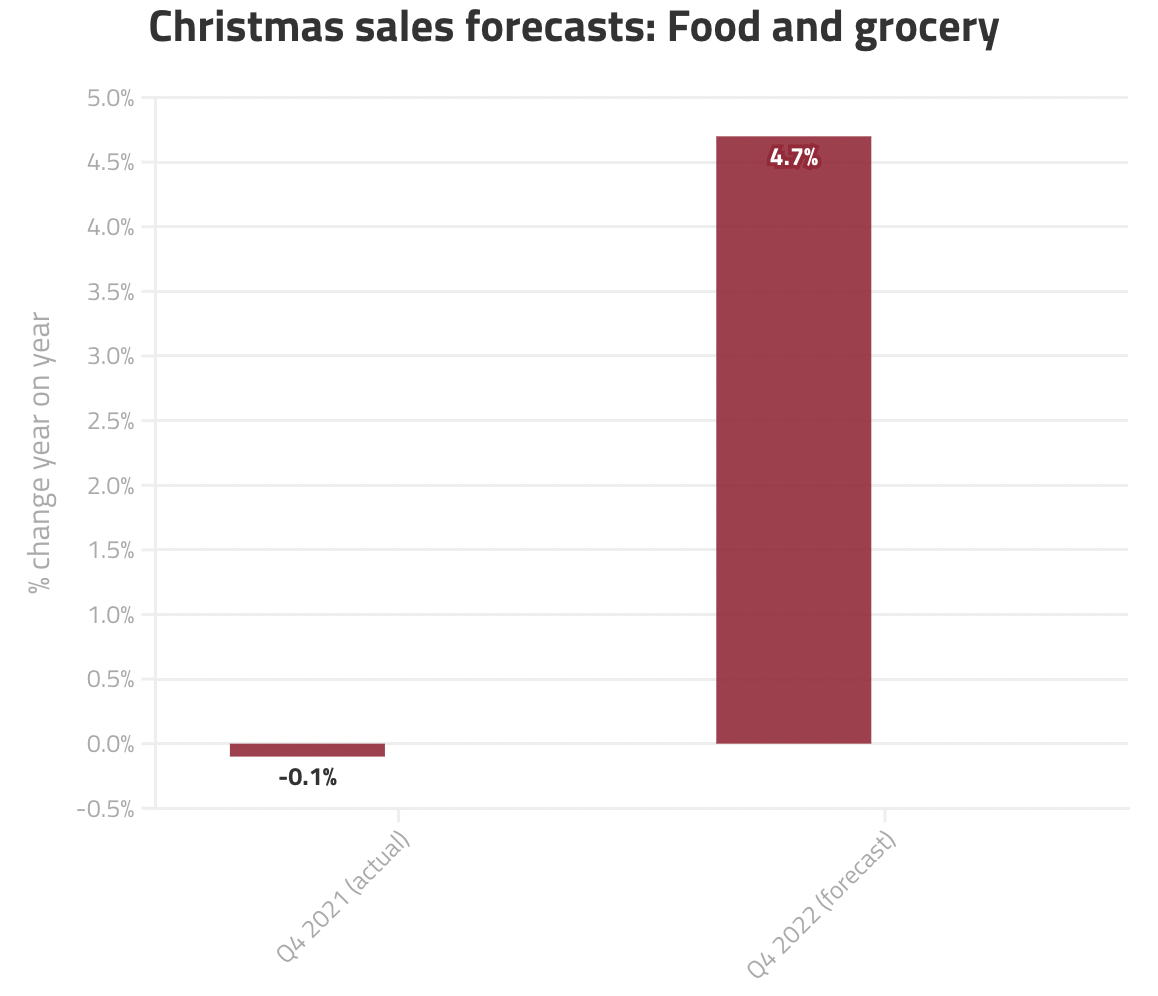

An example of this is how Aldi recently overtook Morrisons to become the UK’s third largest supermarket, a move not surprising to most, given how well Aldi’s brilliant marketing campaigns always manage to cook up a storm. You could argue this has come at just the right time for Aldi, as some reports suggest Christmas will see a huge amount of spend on food and activities, as many of us seek to have more time together this year, making up for time lost in the previous two years.

We agree with Will Higham from The Next Big Thing, who says:

“Christmas post-lockdowns in 2021, retailers rightly focused on bringing people together, and that hasn’t gone away. Just because people have been able to spend time with one another over the past six months they aren’t going to be bored of it by Christmas – it will be another excuse to get together.”

Retailers will be focusing on how they can bring people together, and how their products can be used to encourage social gatherings.

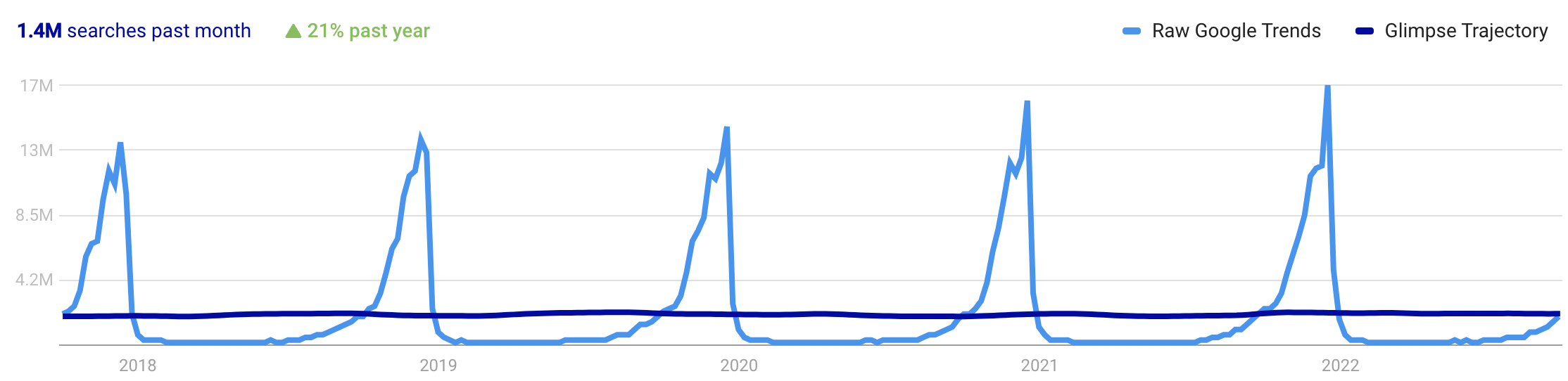

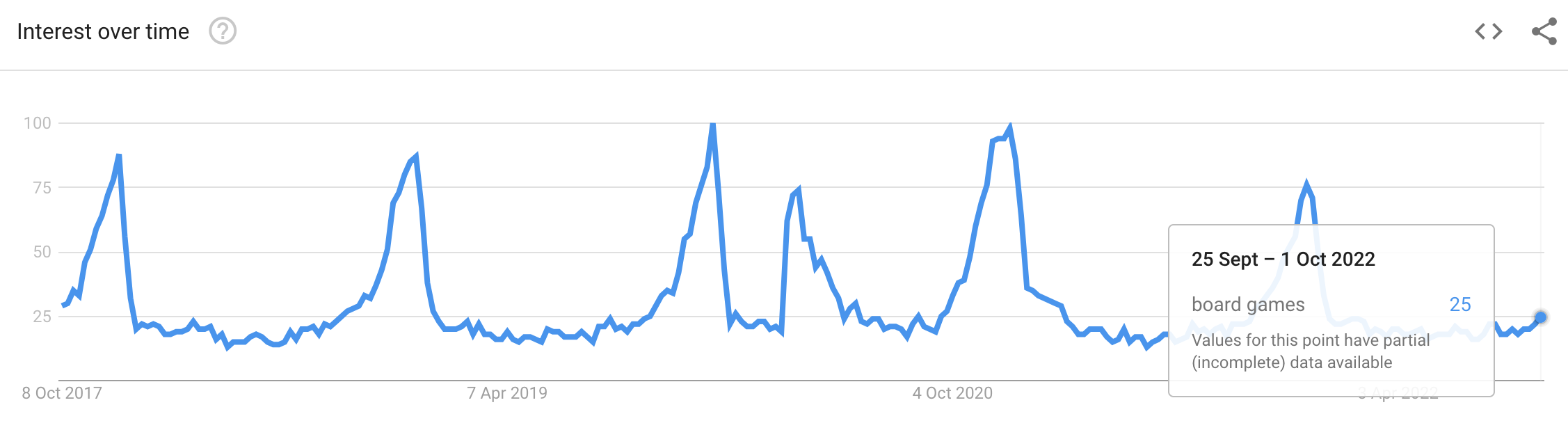

We can this see already as search terms for ‘Board Games’ have already started to increase in popularity, much sooner than they usually do at this time of year.

We predict that this year board games will see a three year high in popularity, but it may be that they will see a five year high as socialising with family will be a big trend of this Christmas.

What other sectors may be popular this Christmas?

Given what we know about household goods such as furniture and lighting during the pandemic and afterwards, coupled with the prospect of people coming together this year more than last, it’s a safe bet to say household goods will soon be on the rise, again.

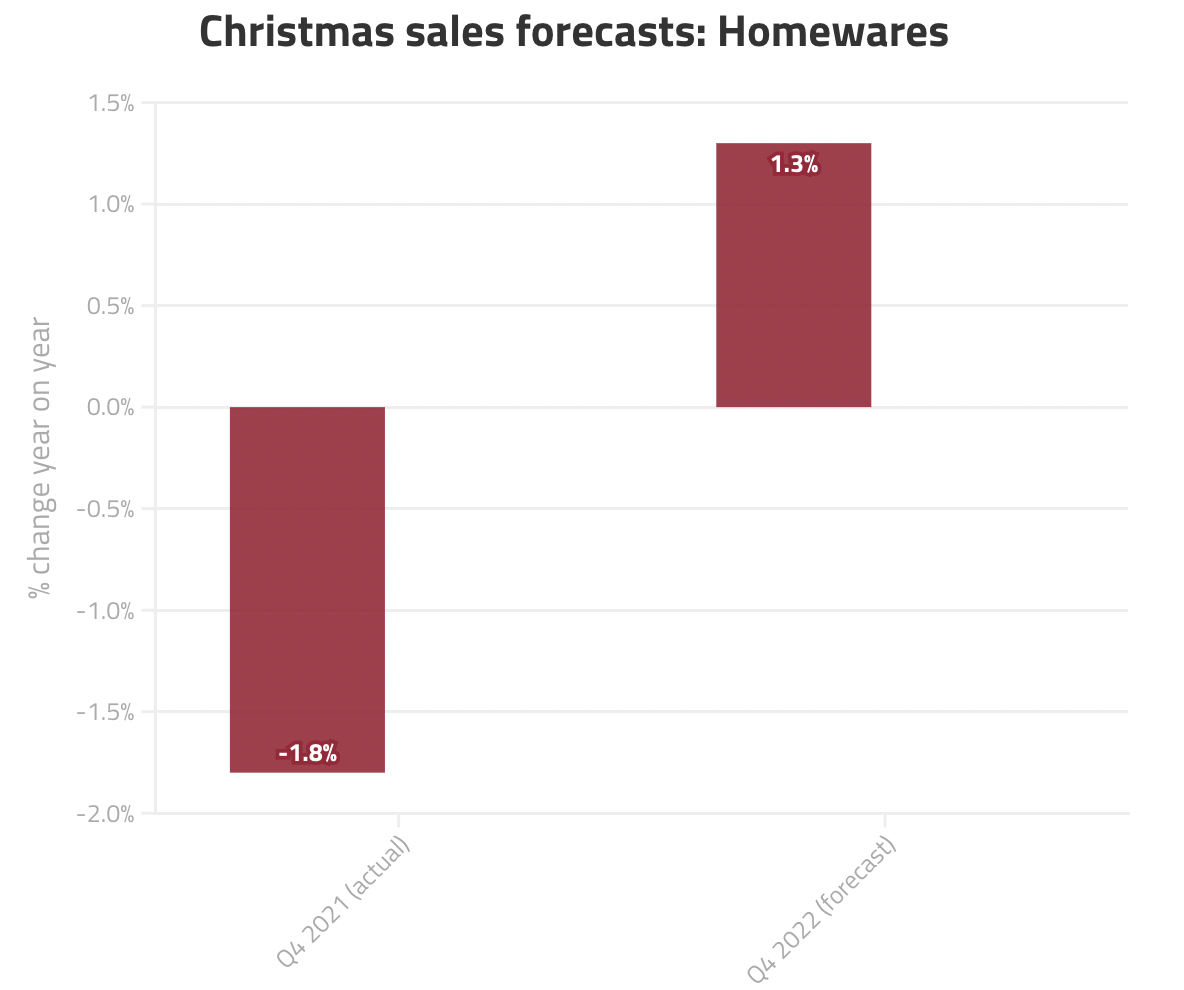

Current forecasts suggest we will see a 1.3% increase in Q4 of 2022, partly due to an increase in inflation that will see the average value of orders increase, without people necessarily buying more in quantity.

Kingfisher, owner of B&Q, recently announced that their sales had dropped in recent months after a strong couple of years during the pandemic. However it is likely people will still seek to refresh their Christmas decorations and interiors this year, given the increase in socialising that we are expected to see.

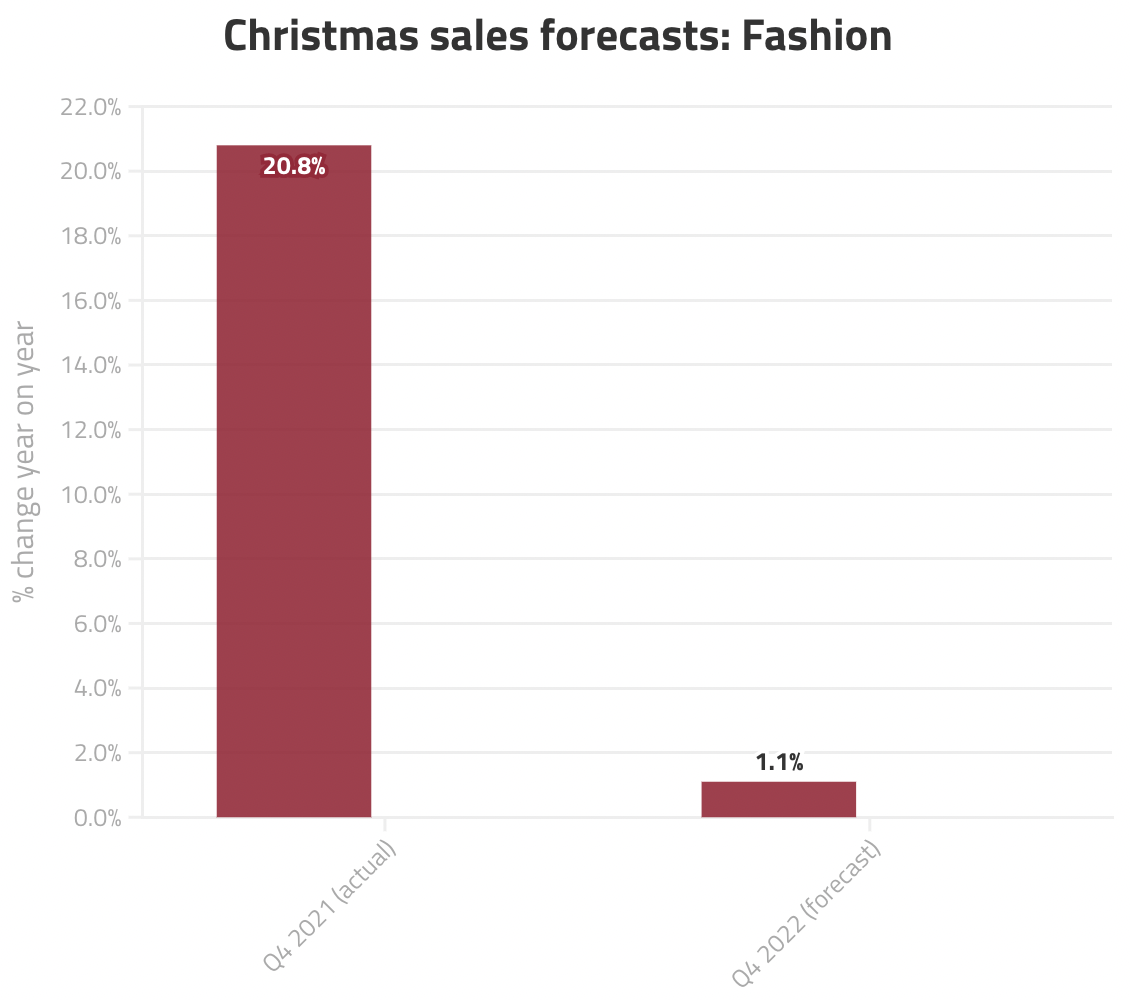

Clothing is also expected to see minor increases in sales this year, again perhaps driven by our desire to make up for lost time – sales are predicted to rise by just over 1% this year. Last year saw a surge in clothing sales, with a 20% increase on the year previous. Given that 2021 still saw a lot of caution over Coronavirus, we’d expect to see a larger than 1% increase this year over last, but only time will tell.

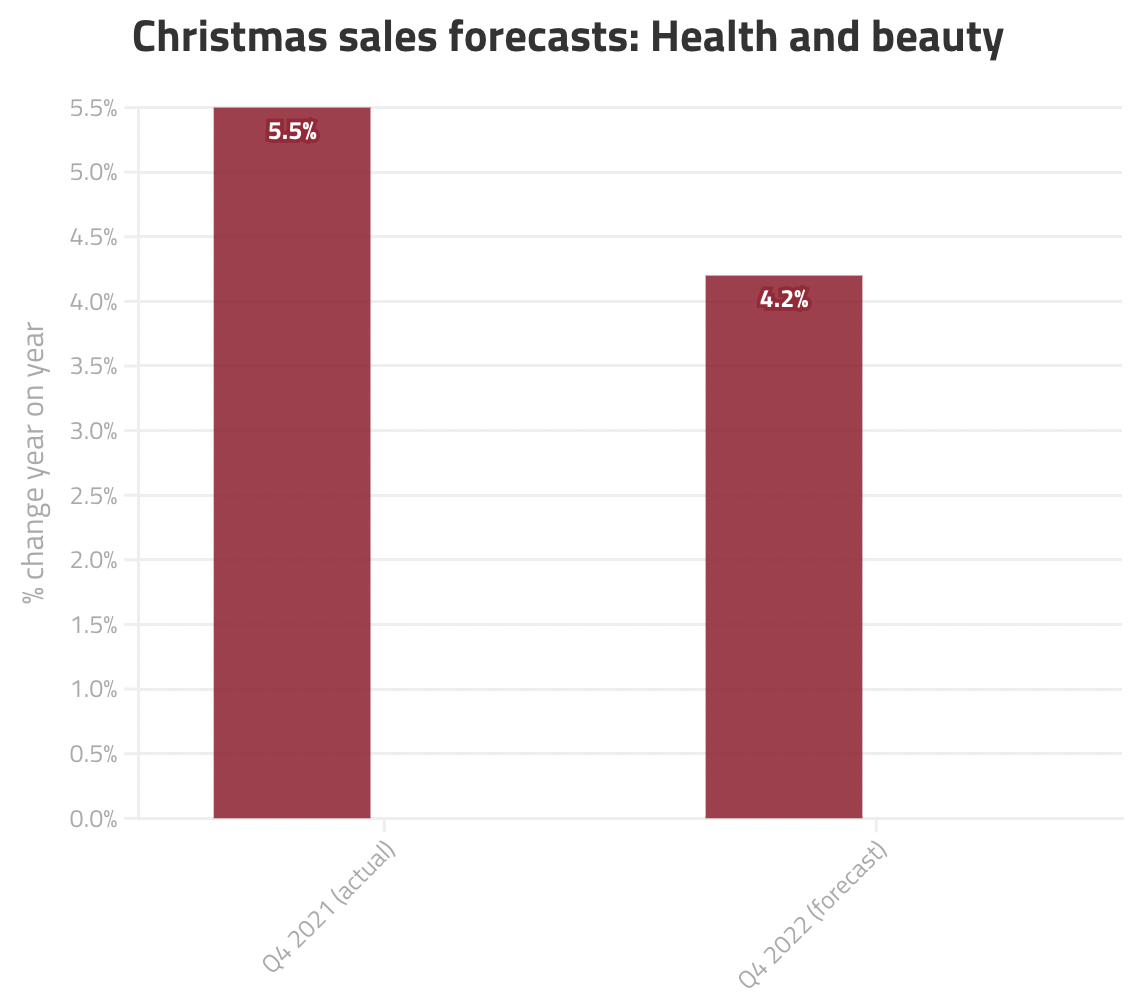

Similarly to clothing, beauty is also expected to do well, seeing the largest increase in overall sales once we account for inflation.

The beauty sector isn’t without its challenges, but despite current economic woes, many people are keen to spend money on themselves in order to look and feel their best, with the festive season being one of the most popular times of year to do so.

Conclusion

In conclusion, whilst it’s one thing to look at various data trends of the past couple of years, as well as forecasts for this Christmas, it’s also vital that you examine your own data over the past couple of years and potentially further, if possible. This, along with pre and during-covid context, will give you valuable insight into your customer base and what they might need from you in the coming months, helping you to shape your sales and marketing strategies accordingly.

If you’d like some support with planning your 2023 marketing strategy, our team would love to help. Get in touch using the form below.